GAAP/IFRS Conversion Services

With globalization, the presence of Indian companies across the world has increased. It requires adjustment to various new processes, including financial reporting in the accounting framework accepted across the world.

International Financial Reporting Standards (IFRS) and US GAAP (Generally Accepted Accounting Principles) are the two frameworks widely used by Business across the globe. Moreover, the focus on quality and transparency of financial reporting has also increased. This is where KMS plays a strong role. We provide GAAP Conversion and IFRS Conversion services, where we restate the financial statements in line with the GAAP and IFRS requirements. GAAP Conversion/IFRS conversion is essential in transactions such as raising equity/debt in a different geography or in case of cross-border acquisition transactions where acquiree’s books are required to be converted. We also provide on-going US GAAP/IFRS consultancy services to enable our clients to be on time with their compliance with international accounting requirements on a real-time basis.

As an eminent CA firm in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Check out our website to understand and know more about our services and firm.

GAAP Conversion Services

Our GAAP Consultants in India provide a range of services to our clients on GAAP conversion as follows:

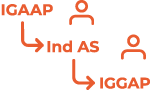

IGAAP to Ind AS conversion and Ind AS to IGAAP conversion

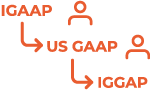

IGAAP to US GAAP conversion and US GAAP to IGAAP conversion

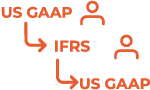

US GAAP to IFRS conversion and IFRS to US GAAP conversion

IFRS Conversion Services

Our IFRS Consultants in India provide the following IFRS conversion services:

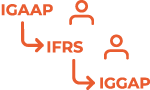

IGAAP to IFRS conversion and IFRS to IGAAP conversion

IFRS to Ind AS conversion and Ind AS to IFRS conversion

IFRS to US GAAP conversion and US GAAP to IFRS conversion

Key activities

- Preliminary assessment accounting gaps and the impact of conversion

- Support on planning for the first time adoption of Ind AS/IFRS/US GAAP

- Preparation of converted financial statements

- Training on US GAAP conversion and IFRS conversion methodology to build in-house expertise

- Help in preparation of disclosures required when adopting a new accounting framework

- Auditing documentation

- Preparing detailed diagnostic reports useful in conversion

- Preparing accounting opinions on the application of different accounting framework such as US GAAP, Indian GAAP, IFRS, Ind AS

- Technical training required for client’s employees on accounting standards

- Assistance in implementation of the new accounting standards

- Preparing GAAP/IFRS adjustment computation templates for clients

key differences of kms

Our clients approach us because we have the in-house knowledge, expertise, and experience to deal with conversion to US GAAP/IFRS for all kinds of businesses in various industry sectors. The key benefits that KMS provides are as follows:

Khandhar Mehta and Shah (KMS) have access to one of the largest accounting and consulting networks that help us in the process of consulting our clients throughout our engagement with them during GAAP/IFRS conversion to ensure timely and smooth completion.

our clients say

trust. transparency. professional expertise.

frequently asked questions(faqs)

Subscribe to KMS Newsletter