Auditing Services

Khandhar Mehta and Shah Auditing Services

Businesses know the importance of Audit services

As it is a stepping stone and medium for firms to thrive and safeguard the business from unforeseen situations.

Businesses know the importance of Audit services as it is a stepping stone and medium for firms to thrive and safeguard the business from unforeseen situations. As an auditing firm in Ahmedabad, we provide assurance services to our esteemed clients. Our pragmatic approach towards issues, open communication, risk analysis, and providing early warnings is the most distinguishing feature of our auditing services in Ahmedabad. Our Audit services are the hallmark of trust, transparency, and value. We take time to understand the business and needs of our client and provide personalized and professionally-curated audit and assurance services in Ahmedabad.

What is auditing?

Accounting and auditing are two crucial functions for any business, whether small, medium, or large. Accounting includes recording financial transactions and preparing financial statements for the readers to draw meaningful conclusions and take economic decisions.

As a CA firm in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Check out our website to understand and know more about our services and firm.

objective of auditing

EXPRESSION OF

OPINION

One of the primary objectives of auditing is to provide an opinion if the financial statements of the company represent a true and fair view of its state of affairs and profitability. Auditor also checks the accuracy of accounting records prepared in accordance with the relevant accounting standards and statutory requirements.

INDEPENDENT

OPINION

At KMS, our auditors work with integrity and honesty when it comes to providing the auditing services. Without getting influenced by the management or circumstances, the auditor maintains high ethical standards and expresses his independent opinion on the financial statements.

DETECTION AND PREVENTION OF FRAUD AND ERRORS

Auditing detects the error from the grass-root level. Auditing services help in the discovery and correction of the errors and ensure the accuracy of the books of accounts. However, the statutory auditor, despite following a risk-based auditing approach, may not be able to detect carefully planned frauds, which is one of the limitations of auditing.

Scope of auditing Services

The scope of our auditing services mainly depends on three aspects-

Terms of the engagement. Pronouncement of ICAI. Statutory requirements.

different type of audit services

GST audit

As an GST auditing firm in Ahmedabad, we examine the returns, records, and other essential documents of the GST registered business having turnover more than Rs. 2 crores. We ascertain the correctness of taxes paid, refunds claimed, and turnover declared by the company to check the regulatory compliance.

Statutory audit

We provide statutory audit services in Ahmedabad and express our opinion if the financial statements of the company provide a true and fair view of its state of affairs and profitability. At KMS, we firmly believe that statutory audit should be seen as an opportunity for soaring high and not as an overhead task.

Internal audit

Our internal audit service in Ahmedabad involves continuous evaluation of operations of the company to suggest various improvements and strengthen the overall governance of the company. It also focuses on ensuring a robust internal control system to achieve operational efficiencies.

Concurrent audit

We provide concurrent audit services to our clients where we systematically and timely examine all the transactions to ensure accuracy, compliance with procedure, and authenticity of the transactions. It helps in the timely detection of mistakes and irregularities.

Management audit

Our management audit service assists our clients in ascertaining the effectiveness of managers and policies, systems, and methods that are implemented. It helps identify weaknesses and ways to strengthen the managerial function.

Compliance audit

Our compliance audit services evaluate compliance with regulatory requirements, external laws, controls, policies, and procedures. It helps in identifying lapses so that one can remain compliant and avoid legal complications and penalties.

Forensic audit

Forensic auditing is aimed at gathering legal evidence that can be used in the court of laws. We analyze financial transactions and apply specialized audit procedures to meet the requirements of terms of engagement.

Information system audit

The information technology infrastructure is one of the most crucial parts of any business today. We provide information system audit service where we examine IT and management controls and determine if they are operating effectively to meet organizational goals.

Tax audit

As per Section 44AB of the Income Tax Act, an assessee needs to get a Tax Audit done if his sales, turnover or gross receipt exceeds Rs. 1 Crore in the financial year. We provide Tax auditing services in Ahmedabad to help our clients comply with regulatory requirements.

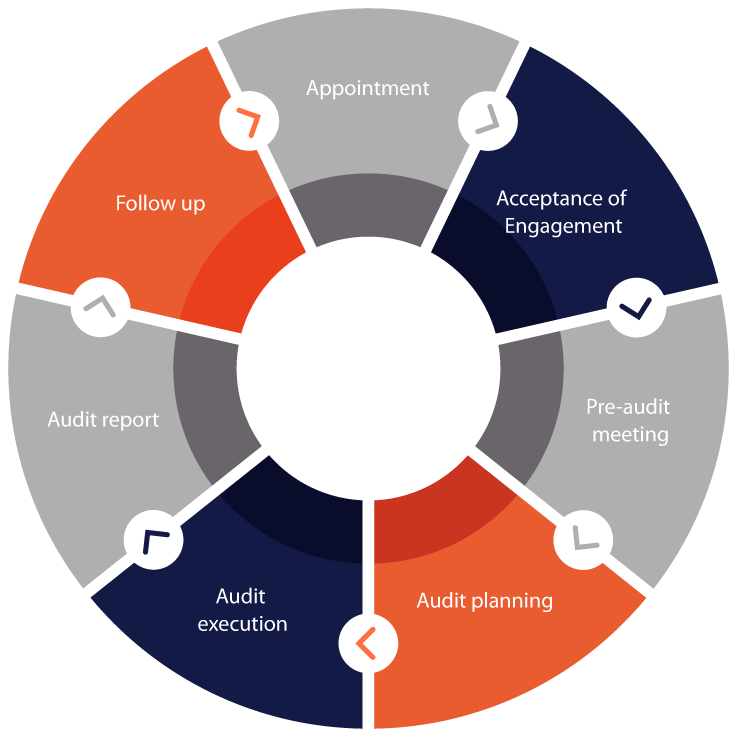

auditing process

why is kms your best choice for auditning services?

today’s corporate world is getting less and less tolerant of errors and inaccuracy

Today’s corporate world is getting less and less tolerant of errors and inaccuracy. Shareholders, creditors, users of financial statements, and the government expect auditors to provide an accurate and independent opinion on the financial statements. At Khandhar Mehta and Shah, we make sure we incorporate all the tools and procedures which reduce these errors. In our auditing service, we focus on procedural robustness, constant reliability and support, and operational consistency.

what our clients have to say about our auditing services?

trust. transparency. professional expertise.