GST Audit Services

With more than three years since the implementation of goods and services tax, taxpayers have been discharging their duties by complying with the requirements of the GST Act.

Registered Businesses need to be ready with the input and output tax reconciliation and prepare and file an annual return. The law also prescribes an independent audit under GST when the taxpayer's turnover exceeds Rs. 2 Crore. GST laws also prescribe for special audit by a Chartered Accountant or Cost Accountant on a need basis. KMS offers an experienced team of Chartered Accountants to carry out GST audit services in Ahmedabad.

What is GST audit

The basic purpose of auditing under GST is to make sure that the ITC refunds availed and claimed, taxes paid, and the turnover is in line with the one claimed by the company. An audit under GST involves inspection of records, returns, and documents furnished by your firm. The GST audit is undertaken to evaluate whether the business is run in compliance with the GST guidelines and provisions.

Importance of GST Audit

It helps in detecting errors like short payment or non-payment of tax and failure to comply with the provisions of law. It helps comply with the provisions related to the taxability of goods and services and identifies excess claim over input tax credit (ITC).

Being a renowned CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

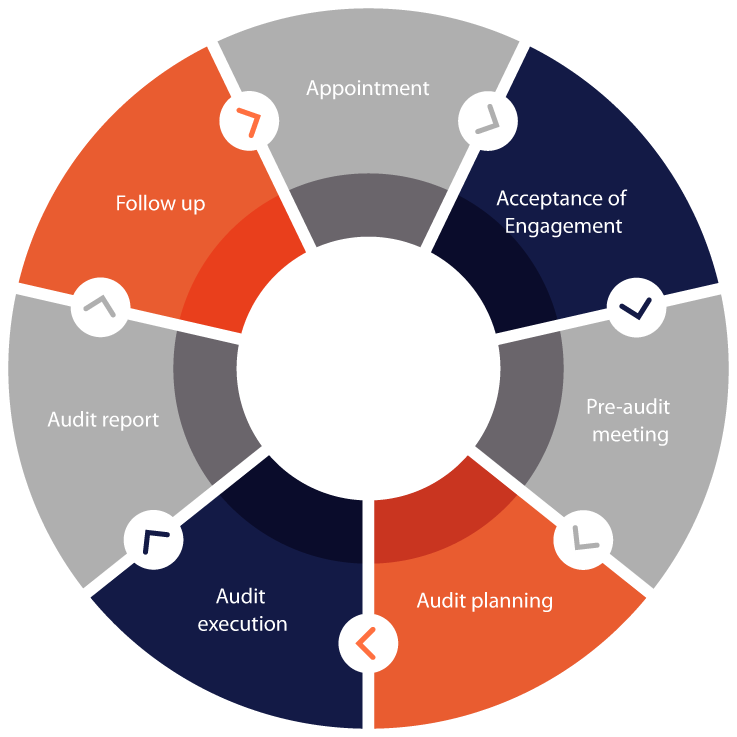

gst audit process that we follow:

GST Audit Form GSTR-9c

As per the central goods and services tax (CGST) act, 2017, the taxpayer is required to file form GSTR-9C on or before 31st December of the subsequent financial year. Form GSTR-9C comes in two parts viz., Part A and Part B.

Part A is the reconciliation statement with five sections requiring the following information:

Basic details

Reconciliation of the turnover as per the audited annual financial statement with the one declared in the annual return (GSTR-9)

Tax Payment Reconciliation

Input Tax Credit (ITC) Reconciliation

Auditor's recommendation on additional liability due to non-reconciliation

Auditor issues certificate under Part B certifying the correctness of part A and the details submitted in the annual return.

The taxpayer is also required to submit an annual return along with GSTR-9C. The GST annual return requires him to furnish information as to inward supplies, outward supplies, ITC reversed, ITC availed, ineligible ITC, HSN summary of inward supplies, HSN summary of outward supplies and details of demand and refund.

gst audit procedure that we follow:

We follow the following procedures and checklists to carry out the audit:

Study of internal controls

Our auditors study the effectiveness of internal controls and internal checks established by the management to ensure GST compliance. A review of internal controls applicable to transactions like sales returns, sale on approval basis, and job work is also carried out for their completeness and actual implementation. Our GST auditors also study the adequacy of records maintained under GST and provide their recommendations.

records verification

Our GST Auditors verify the GST registration certificate, classification of supplies and services under GST, reverse charge, purchase register, sales register, stock register, expense ledgers, monthly and quarterly returns, and other records maintained by the company as per the requirements of the law.

Our GST Auditors verify the GST registration certificate, classification of supplies and services under GST, reverse charge, purchase register, sales register, stock register, expense ledgers, monthly and quarterly returns, and other records maintained by the company as per the requirements of the law.

cross verification of GSTR-3B to GSTR-1 AND 2A

We cross-check GSTR-3B with GSTR-1 and 2A to ensure that input tax credit has been properly claimed. We also check the arithmetical accuracy of figures and identify mismatch, if any. Based on our findings, we recommend management to make necessary changes.

invoice verification

>We check the outward invoices to ensure that the format of the invoice complies with the law. We then go on to check the arithmetical accuracy of the same and check if the tax rate is correctly charged considering the goods and services supplied.

We also check purchase invoices for their eligibility for input tax credit (ITC) and verify if the total of such ITC matches with the amount of credit claimed in the GST return.

We check the outward invoices to ensure that the format of the invoice complies with the law. We then go on to check the arithmetical accuracy of the same and check if the tax rate is correctly charged considering the goods and services supplied.

We also check purchase invoices for their eligibility for input tax credit (ITC) and verify if the total of such ITC matches with the amount of credit claimed in the GST return.

ICt non-payment reversals

Our GST auditors check if the input tax credit is reversed if the invoice under review has remained unpaid for more than 180 days.

E-way bills compliance check

We check if the e-way bill is generated for each supply having value more than Rs. 50,000 and supplies made via motorised vehicles. They also check if the e-way bill matches the invoice.

We check if the e-way bill is generated for each supply having value more than Rs. 50,000 and supplies made via motorised vehicles. They also check if the e-way bill matches the invoice.

industry-specific check

Some of the GST provisions apply to specific industries. Our GST auditors carry out further examination of the records if specific provisions are prescribed for your industry.

Key features of KMS

If you are looking for a professional auditing experience, then you must know that it requires a thorough experience, skills, robust digital environment and mechanism for the examination of accounts and records to ensure complete compliance with the tax laws.

With decades of experience and a pool of GST professionals, KMS provide transparent and trustworthy GST audit services in Ahmedabad.

our clients say

trust. transparency. professional expertise.

frequently asked questions(faqs)

Every business or registered person whose annual turnover is more than Rs 2 crores must get a GST audit done from a practicing chartered accountant or cost accountant.

Aggregate turnover = Value of all taxable (inter-state and intra-state) supplies + exempt supplies + export supplies of all goods and services