Payroll Outsourcing Services

Introduction

Managing the payroll is a critical task for any company since it manages two important assets of any company – human resources and money.

However, it is time-consuming and complicated due to the involvement of multiple factors and phases. We, at KMS, have the industry expertise and deep understanding of payroll outsourcing services that ensure high standards of payroll management. The best part about our payroll processing services is that your employees will have all-round accessibility to salary statements, payslips, available benefits, Form 16, and other reports.

We manage and maintain a centrally-located payroll software that has error-free data records of each employee, accessible to the founding management for review purposes. Our clients can be assured of our ethical business practices and professional support in the handling of outsourced payroll services. KMS’s expert professionals take compliance with payroll regulations seriously and hence provide reliable payroll management services.

With our payroll services, you can save time and costs and be sure of accurate payroll processing. Our payroll outsourcing services help you focus on your core business activities while we confidently handle your payroll processing.

As an eminent CA firm in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Check out our website to understand and know more about our services and firm.

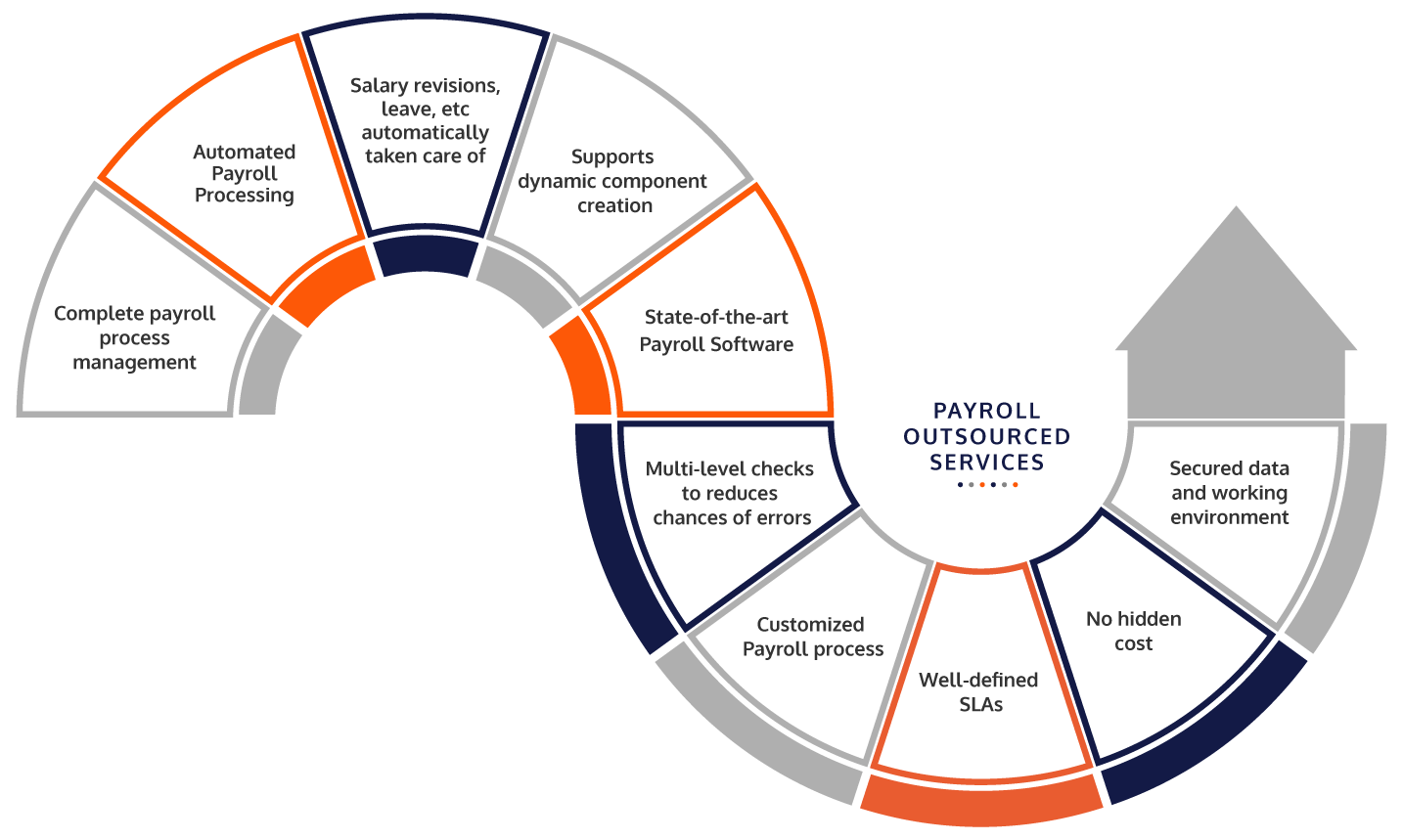

Our Outsourced Payroll Services

KMS provides the following key services related to payroll:

Processing monthly pays, compensations, and any outstanding amounts

Our payroll consultants handle the calculations and payments of monthly salaries of all the staff members, considering the latest legislative updates related to the same. We develop an HR and Payroll system customized for each client and update it with relevant details whenever a new joiner joins the organization along with the investment declarations. Based on the HR and Payroll system, we develop reports and presentations that provide analysis and insights to clients on their employees, their salaries, taxation, and investments. Our payroll outsourcing services ensure that the integrated Payroll system generates salary slips that can be distributed to the employees, and we maintain salary statements of past years for internal use of the clients.

Handling investment declarations and returns filing

We assist the clients with our expertise and knowledge on the complex process of choosing the best investment strategy from the multiple options available for their employees. We develop an interface for the employees, which they can use to submit their investment declarations that are fed directly into the HR and Payroll software for calculation of taxes. Moreover, as a part of our payroll outsourcing services, we also provide planning assistance to employees to plan for maximum savings from taxes through possible investment opportunities available to them. We manage the end-of-the-year process of generating Form 16 and provide our support in IT returns filing to minimize the errors.

Filing and submission of Form 24Q

Form 24Q is an online TDS return form, filed quarterly, which is used for the amount deducted on salary under section 192 of the Income Tax Act. We, at KMS, help our clients comply with accurate processing and calculations of the quarterly TDS returns from the salaries and ensure that these are filed every quarter without fail. We provide the most accurate and comprehensive reconciliation process in regard to the deduction of taxes as a part of our payroll outsourcing services. We check for any variances, get these clarified from the client’s internal team, upload the base file into the eTDS and then generate the Form 27A, which is shared with the clients for future use.

Ensuring payroll compliance

Khandhar Mehta and Shah’s strong team of payroll advisors and consultants are the industry experts with knowledge on all the details and complexities involved in the full and final settlement process of employees. We ensure that through our payroll outsourcing services, our clients achieve compliance in all the matters related to payroll such as:

- Calculation of payable days

- Managing the investment proofs submitted by employees and any reimbursement claims received during the final settlement of employees

- Managing the compliance with Provident Fund (PF), Professional Tax (PT), Labour Welfare Fund (LWF), and Employee State Insurance (ESI)

- Calculation of leaves and leave encashment and notice period recovery

-

Ensuring all the payments and deductions are considered

in the calculation of salaries and annual package

- Handling the generation and preparation of consolidated reports on tax calculations and deductions, journal vouchers, the net payable and recoverable and many more

Resolving employees’ queries

Our bunch of payroll professionals is approachable people for employees in our client companies for queries and concerns on salaries, annual package, leaves, calculation of taxes, leave encashment, yearly bonus, various options of benefits available, reimbursements, or tax declarations. Our outsourced payroll processing team responds accurately and swiftly to the clients’ employees, thereby resolving their queries.

Our Outsourced Payroll Processing Methodology:

key differences of kms

Why would you select KMS as your payroll outsourcing services provider? We give you reasons to choose us as the preferred payroll processing vendor.

We have the domain expertise to provide you outsourcing Accounting services and solutions customized to your business requirements, industry sector, and the changing regulatory landscape so that you can focus on your business growth while we focus on rendering payroll outsourcing services at global level standards.

our client say

trust. transparency. professional expertise.

frequently asked questions(faqs)

• To avoid the requirement to hire in-house resources for handling payroll services, thereby saving costs

• To ensure that payroll is administered easily and smoothly

• To avoid mistakes and resulting penalties and ensure compliance with all the statutory requirements of the government and related departments

• Payroll outsourcing services help employers focus on their core business activities and hence improve their productivity.

• In the case of small business owners, the number of employees is less, and it becomes costly to hire an in-house payroll-related member, so outsourcing payroll processing is more advantageous.

• There are increased chances of an in-house staff member making more errors as compared to an external services provider in payroll activities, so to avoid that outsourcing payroll services is better.

• An external payroll outsourcing services provider can engage experts who constantly keep themselves updated to remain abreast of the latest changes and trends.

• External outsourced payroll services providers can ensure higher security for payroll-related activities of each client separately and advanced technology for payroll-related software.