Due Diligence Services

Khandhar Mehta and Shah | Due Diligence

Introduction

Businesses ought to make many strategic decisions that affect their operations, profitability, and growth in the years to come.

Some of these strategic decisions, such as investment/disinvestment, bank loan, acquisition, merger/demerger, business partnership, or organizational effectiveness initiative, require critical consideration. This is where Diligence helps, meaning that research and analysis are conducted to determine if the transaction is feasible and value-generating for the business or if it will face significant obstacles or any concerns that may result in bleak outcomes. Therefore, it must be accurate, clear, and timely for it to play a pivotal role in the company’s strategic management decisions. KMS provides due diligence services to clients to help them make informed decisions.

We, at KMS, engage in obtaining all the information necessary for an in-depth study and analysis of the transaction within the timelines and provide the best recommendation to our clients. We ensure that our review helps you to take the transaction forward with cautious strategies so that it does not end up as a costly mistake. Our dedicated and sincere professionals provide due Diligence and transaction advisory services to clients concerning the legal, financial, business environment, and tax domains of a business’s operations.

As a renowned CA firm in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Check out our website to understand and know more about our services and firm.

Due Diligence Services

The various types of due diligence services include:

Financial

financial due Diligence, we conduct an in-depth study of the present and historical financial statements, accounts, and the relevant compliances to identify the potential risk areas. Such an investigation leads to the identification of the key revenue items, cost items, non-performing segments, assets and liabilities, non-core assets, hidden or contingent liabilities, and similar other data-related trends.

The risk of taxes may also influence any financial transaction of the businesses. Hence, financial due Diligence also includes an analysis from the tax perspective. It answers questions such as – Are all the tax payment deadlines followed? Is there any trend of unpredictability in profits? Are there any liabilities that may harm the Business in the years to come? Are the assets valued correctly? Is there any additional direct or indirect tax applicable to the transaction?

Legal

There are many legal risks in a business restructuring transaction, and hence a profound analysis into it facilitates the study of the transaction. Therefore, we conduct a comprehensive assessment of assets, securities, existing agreements, taxes, intellectual property, contracts, and many more. Furthermore, we have the legal experts required to draft the transaction contracts and agreements, taking into consideration the legal aspects and the business angle of the transaction.

Our legal experts also get involved in the negotiation process on behalf of the clients. It helps to avoid any kind of possible legal pitfalls that may diminish the value of the transaction. A thorough analysis of the legal risks and potential solutions for these risks enables the KMS team to draft a legitimate agreement with the least threats possible. KMS aims to determine all the liabilities, manage the risks, and negotiate the optimum cost-benefit for the advantage of the client company.

Customer

Customer due diligence is essential to find out the relevant information regarding the customers and evaluate them against any risks of money laundering and terrorist financing activities. It is a way to identify your customers and their risk profile. In some countries, it is conducted under the legal ambit, and if not followed by companies, they may be charged penalties.

We assist our clients with KYC checks, including full name, residential address, place, and date of birth, gender, nationality, marital status, contact number, email address, occupation, specimen signature, government-issued identification number, and tax number. Depending on the transaction, the company may require further due Diligence of customers. Furthermore, regular customer monitoring is also conducted to keep a tab on the customer’s risk profile that may change over time.

Vendor

Before entering into an agreement with the vendors, businesses need to check whether the vendor has the financial capability, operational competence, and a sound system of corporate governance. This is required for any company to decide whether to enter into an agreement with them or not so that the risk to reputation and compliance is minimized.

Besides, it is also critical to analyze the business relationship that the company has with its vendors to identify the compatibility of both the companies. Such due Diligence also enables the company to identify any changes at the vendor’s end and the impact it may have on the relationship so that a better deal can be arranged for.

M&A

Due Diligence is critical in transactions when two companies plan to merge or when one intends to acquire another to understand if the deal will be beneficial or not. In this process, our expert professionals gather information about the target company, its customers, technology used, assets and liabilities, suppliers, financials, and intellectual property.

This information enables both the companies involved in the transaction to adjust their expectations from the Business Restructuring. It helps in risk identification, the definition of a clear structure, and better reputation management.

Technical and other due

Assessment of the technical feasibility of the transaction is a critical requirement to gauge if the company is ready to go ahead with it, given the technological capability, financial resources, and human talent. Some transactions also require an investigation into the educational, professional, and financial backgrounds of the promoters of the company, company structure, and ownership. There are some other transactions, which require us to assess the internal and external environment of a company to check for commercial viability. Operational due Diligence is another service, which studies the company’s daily operations, procedures in place, internal controls, and business processes that are required to identify any operational inefficiencies.

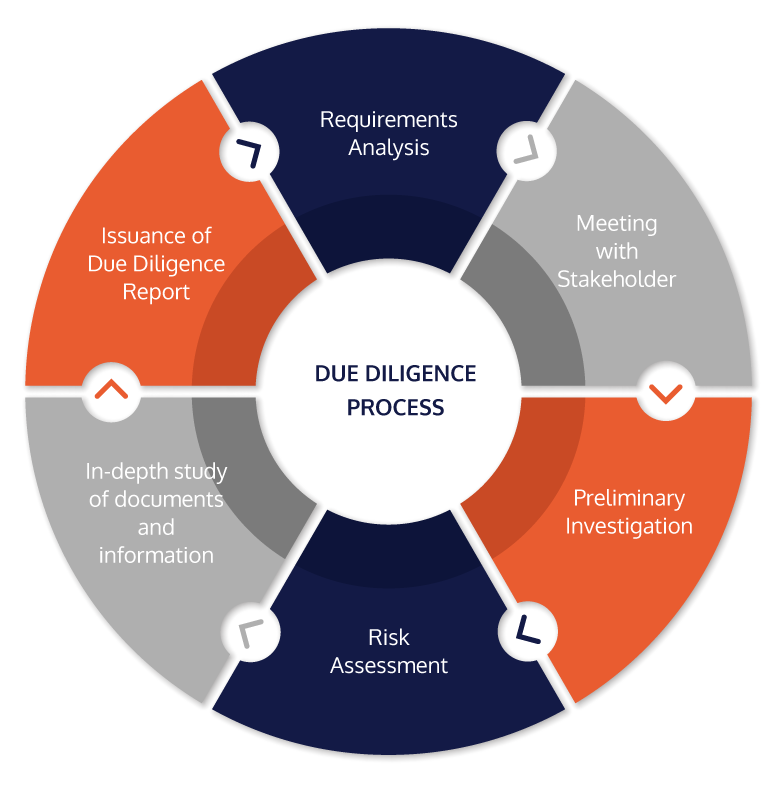

Due Diligence Process

Key features of kms

our clients say

trust. transparency. professional expertise.

frequently asked questions(faqs)

The key information included in a due diligence report contains information about the company profile, financial information, employment and labor, infrastructure, agreements, supplier’s data, customer’s data, and legal information.

•The company profile includes information on the company name, registered address, business form, geographical presence, capitalization, articles of association, memorandum of association, and shareholders and their percent of shareholding.

• Financial information includes copies of audited financial statements for the last few years, correspondence between auditors and company representatives, tax returns for the last five years, financial models and forecasts, and board of directors’ presentations.

• Information about employment and labor includes a list of officers, directors and senior management and their biographies, list of employees and their designation, department, location, and compensation, copies of all human resources policies and employee handbooks, any cases related to employment law, and details of any employee-specific incentives or benefits.

• Information about agreements includes all customer agreements, licenses, subscriptions, material contracts, investment banker agreements, real estate leases, joint venture agreements, and any marketing, sales or promotion agreements.

• Legal information includes copies of all government licenses, any litigation, proceedings, investigations conducted on the company, and copies of documents filed with government agencies.

• Infrastructure-related information includes a legal description of all real properties, all appraisals, all studies and site evaluations, consultant-generated reports, and title issuance policies.

• Supplier and customer information includes a list of all customers along with their sales volume, list of all suppliers along with their purchase volume, and list of any complaints or disputes related to customers or suppliers.