GST Compliance Services

Khandhar Mehta and Shah | GST Compliance Services

Introduction

The goods and service tax (GST) came into force in india from july 1, 2017.

It replaced multiple indirect taxes and put everything under one umbrella. KMS has a team of expert GST consultants who can provide you GST compliance services. We can help you navigate through the complex maze of GST and achieve compliance with all the requirements. Since with the introduction of GST, it has become necessary for businesses to be correct and true granularly in tax reporting, our GST Consultants’ keen attention to detail will make it possible for you. Moreover, since companies have an added responsibility of ensuring that the other third parties involved in the supply chain are also GST compliant, we, at KMS, bring that coordination and communication between the businesses to ensure GST compliance by all. We also keep ourselves updated with all the new amendments in the laws, procedures, and guidelines related to GST compliance so that our clients are not left behind in meeting the requirements of GST regulations.

KMS is your one-stop solution for anything on GST – advisory services on transactions, GST registration, obtaining GSTIN, GST returns preparation, and GST returns filing. We also provide assistance when an audit is required under GST laws; we respond to notice from legal authorities and provide you with all types of GST compliance services.

As a well known CA firm in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Check out our website to understand and know more about our services and firm.

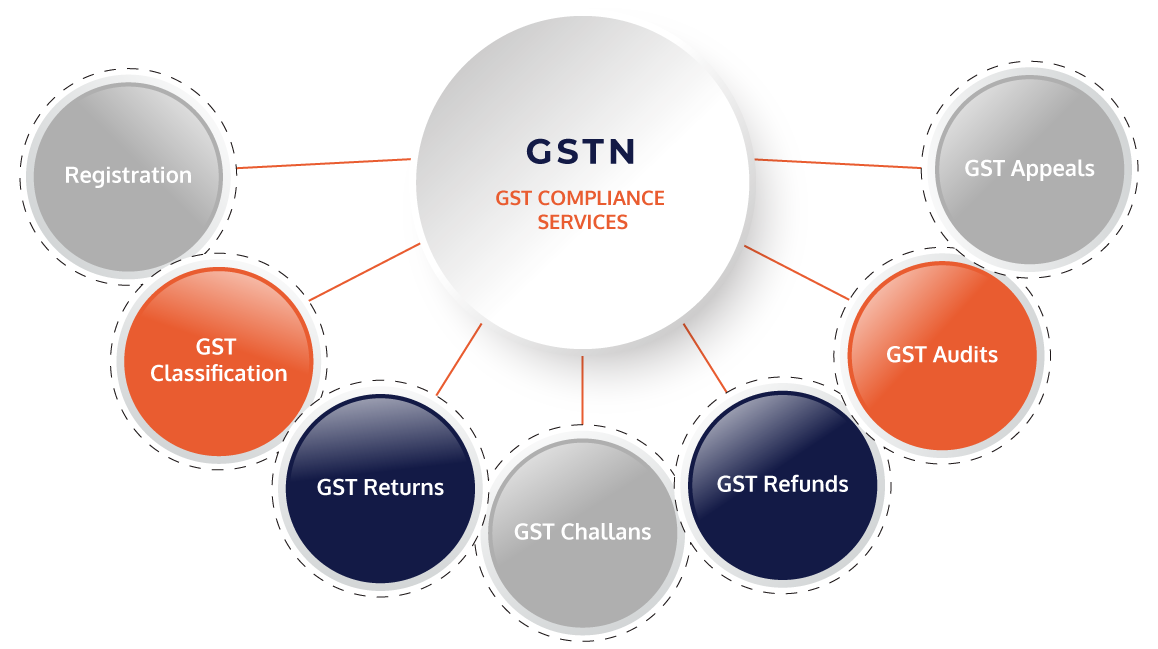

GST Compliance Services

Our GST compliance services include:

GST Registration

We help clients to identify their status as liable for obtaining GST registration or not by checking their aggregate turnover with the GST registration threshold limits and help them avoid penalties for non-registration under GST.

We assist clients in obtaining GST registration by preparing all the documents required for GST Registration and following the GST Registration Process, applying for changes in the details in the GST registration certificate that are incorrect, applying for temporary user ID for those unregistered under GST laws.

We support clients to file for registration at each place of operations of the business in different states. We help clients check their GST ARN status from the GSTN System portal.

We aid clients in obtaining GSTIN and related login credentials. We help to find out the eligibility of the client under the GST composition scheme. We assist the clients in registering as a normal taxpayer, composition scheme taxpayer, casual taxable person, non-resident taxable person, input service distributor, tax deductor at source, tax collector at source or any other under the GST laws.

GST Classification

As a part of our GST Compliance Services, our consultants provide the necessary support to the clients in the classification of their items related to goods and services under the precise HSN or SAC code depending on whether the transaction is related to goods or services respectively.

We apply the relevant provisions related to CGST, SGST, or IGST based on the classification of client’s transactions under inter-state or intra-state supply. We use our experience and knowledge in GST consulting to classify the client’s business transactions based on the place of supply (destination) to determine the correct types of GST applicable to the transaction such as CGST, SGST, or IGST.

Review of Accounting Data

We study the accounting data of clients to check for any necessary GST compliance as per the GST laws. We assist clients in maintaining books of accounts as per the requirements of the GST Act. We commit ourselves to understand the operations and business of the clients to get better insights on the applicability of GST laws and fulfill the requirements of the law.

GST Advisory

Our GST compliance services include expert advice to clients on the applicability of GST on its various transactions and assess the potential impact in different business sectors to find out the GST liability amount. We understand the business of the clients, regulatory requirements and provide them a customized GST Compliance Checklist that they have to follow every month to remain compliant with the requirements of the GST Act.

We provide on-call advisory services regarding any queries and issues under the GST laws. We also address the queries of our clients’ customers and suppliers. Our team assists the clients on an ongoing inquiry or investigation initiated in regards to GST compliance from the government or relevant departments.

We also assist the clients in selecting the right GST Compliance Software.

GST Liability Calculation

Our GST advisors determine the actual period of supply to find out the exact tax period in which GST would be applicable and when the dues are required to be paid. We sit along with the internal accounting team to identify the invoices available for an input tax credit with respect to the relevant provisions. We intimate the clients about payment of taxes as per their liability.

GST Return Filing Services

KMS also verify the data and calculate the GST liability of the client to prepare and file monthly GST returns, or quarterly GST returns if opted for in GSTR-1 or GSTR-3B, quarterly in CMP-08 for taxpayers registered under composition scheme under section 10 of the CGST Act, and annual GST returns in GSTR-4. We also file:

Monthly returns for the non-resident foreign taxable person in GSTR-5

Returns for an input service distributor to distribute the eligible tax credit to its branches in GSTR-6

Monthly return for government authorities deducting TDS in GSTR-7

Monthly return in GSTR-8 for supplies effected through e-commerce operators and the amount of tax collected at source by them.

GSTR-9 annual return for normal taxpayers

GSTR-9A annual tax return for a taxpayer registered under composition levy anytime during the year.

GSTR-9C annual certified reconciliation statement

GSTR-10 for those taxpayers who have canceled their GST Registration

GSTR-11 for taxpayers having UIN and claiming a refund

GST Invoice and other Documents to be maintained under GST

Our GST consultants are also involved in designing the format of tax invoices, credit notes, debit notes, bill of supply, export documentation, etc. containing all the relevant details as per the provisions of GST laws. We also engage ourselves in the thorough review of all invoices and GST documents prepared by the client to ensure that the client issues a GST Compliant Invoice and avoids the possibility of errors and penalties under GST Laws.

Monthly Reconciliations

We also handle the monthly reconciliations where our team determines input tax credit based on taxes paid for the inputs, input services, and capital goods as per the invoices raised and purchases made.

Reverse Charge Mechanism

We help clients in determining the applicability of reverse charge mechanism and the reversals of the input tax credit as availed under the GST laws.

GST Refunds

We assist the clients in preparation and filing of online application along with the relevant documents against which refund is to be claimed. We also engage in following up with the department for the finalization of refund claims. We ensure the refund of Input Tax Credit (ITC) on Export of Goods or Services, the refund of ITC on Inverted Duty Structure, and refund of ITC on Deemed Exports.

Anti-profiteering

Our GST professionals also conduct an anti-profiteering study. We assess the clients’ books of accounts as per the anti-profiteering rules and relevant orders of the National Anti-Profiteering Authority and relevant notifications issued under GST laws to check the applicability of the provisions of anti-profiteering on the client.

E-way bill consultancy

We help clients in preparing and filing E-Way Bills on the GST portal or any other permit document or certificate for the movement of goods.

GST Update

We provide regular updates to clients regarding any notifications or circulars issued by the GST Council under GST laws for GST compliance. We assist clients in applying for resetting the email address and mobile number when the authorized signatory is changed.

GST Compliance Rating

We ensure that the client:

- Pays taxes on a timely basis

- Files GST returns on a timely basis

- Conducts reconciliation on a timely basis

- Complies with all the provisions of GST and

- Co-operates with the GST Authority

All of the above helps the client achieve a higher GST Compliance Rating, and thereby, he enjoys several benefits like:

- Quicker GST refunds and input tax credit

- Appears credible to those who are doing business with him

- Attracts more customers

- Reduced chances of scrutiny/audit by GST authorities.

key features

Are you looking for help in GST registration? Do you want to categorize your transactions as falling under GST or not? Do you want to have the correct calculations of your GST liability? Are you looking for assistance in GST return filing? Do you intend to manage all your compliances under the GST laws swiftly and efficiently?

If you answered yes to any or all of the above, look nowhere else. KMS provides the best GST compliance services.

our clients say

trust. transparency. professional expertise.

frequently asked questions(faqs)

The key benefits of GST are as follows:

- It has eliminated the requirement for taxpayers to pay taxes on taxes

- It has increased the GST threshold limits benefiting the small businesses and service providers

- It has reduced the compliance burden on small businesses

- It has harmonized the tax rates, procedures, and laws, thereby simplifying compliance