International Tax Services

Khandhar Mehta and Shah | International Tax Services

international tax services

With globalization comes a complex maze of international tax laws and regulations that companies are required to comply with to ease the global operations.

KMS is a proficient CA firm in international tax advisory services and international tax consultancy services. We, at KMS, help the organizations with compliance with the prerequisites of international taxation principles, analyze the costs and benefits associated with geographical expansion for the clients, and advise them accordingly. Whether you are a foreign organization, intending to expand in India, or vice versa, our team of international tax advisors, can aid you in strategizing for these initiatives. We assist with compliance in tax reporting obligations, tax strategy assessment, and advance ruling. We undertake a re-evaluation of the existing transfer pricing policy, BEPS risk analysis, review of financial and operational structures. We also help clients in cross border restructuring, litigation before ITAT, high court and supreme court, and other international tax services to ensure tax-efficient operations and reduction in overall tax burden.

Being one of the well known CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

International tax advisory services

Tax strategy

Determining the tax strategies for foreign businesses looking to expand in India or Indian companies intending to set up operations in foreign shores is a critical task. Our professionals are equally good at inbound business structuring and outbound business structuring. Our team of expert international tax consultants supports the clients in these operations through global investment structuring, IPR holding structuring, and cross-border restructuring. Apart from the above, we also guide on matters related to expatriate taxation, TDS, Double Taxation Avoidance Agreements (DTAA), General Anti-Avoidance Rules (GAAR), obtaining tax residency certificates, international mergers & acquisitions, and transfer pricing as a part of our international tax services.

GLOBAL INVESTMENT STRUCTURE

Businesses may consider different types of changes in their transactions to achieve tax efficiency and optimization. Some of these transactions include restructuring, an IPO, strategic alliances, expansion, divestment, group reorganization, and others. KMS’s team of international tax advisors identify the critical tax considerations in such transactions to attain benefits for the clients in such outcomes. They take a global approach to such decisions and advice accordingly on the strategy and business decisions that the clients must adopt and implement. Our team has proven experience in handling internationally-relevant deal structuring and local tax jurisdictions. Furthermore, they have the required dedication and professionalism to recommend the most appropriate choices and actions for achieving the business goals in the most tax-efficient ways.

IPR HOLDING STRUCTURE

When an organization acquires intellectual property rights, it generally creates a separate holding company to separate its operations from the existing arms and subsidiaries and commercialize it differently. Such independent companies enable asset protection and better exploitation of possible benefits. Our international tax services aid the clients in processing the structuring of these IPR holding companies. We provide required advisory services on taxation strategies to get the benefits out of tax havens or otherwise. Our international tax consultants identify the tax-efficient environments or jurisdictions for better management of these separate companies and avoidance of the application of the tax to royalty income generated from licensing IP. Our specialized skills, combined with the best practices of our international tax team, provide one of the best IP tax planning such that it aligns with your business goals.

CROSS-BOARDER RESTRUCTINING

An organization’s insolvency process makes the restructuring difficult and complicated; more so when the business is multi-jurisdictional. Planning the tax implications is a critical area of such transactions. KMS’s cross-border restructuring tax experts use the best practices of domestic and foreign insolvency proceedings of companies with multi-jurisdictional operations. They devise the best tax strategies to handle the cross-border restructuring outcomes.

Planning & Advisory

As international tax advisors and consultants, our team renders all kinds of tax planning and advisory services to the clients in international tax-related matters.

Pre-transaction advisory

Our expert team’s bespoke advice in all areas of taxation enables our esteemed clients to make proper, informed decisions wherever required. Our international tax services include advisory on:

- Setting up and operation of companies

- Taxability on branches, project offices, and liaison offices

- Taxes and regulatory compliance for international mergers and acquisitions

- Migration of intellectual property

- Asset transfer transaction between Indian and foreign companies

- Handling the issues of withholding tax when doing business with Indian companies

- Utilization of foreign tax credits

- Trading transactions in India and related issues of indirect tax

- Advice on intercompany charges

- Shifting the base of holding company outside India

- International tax planning and management

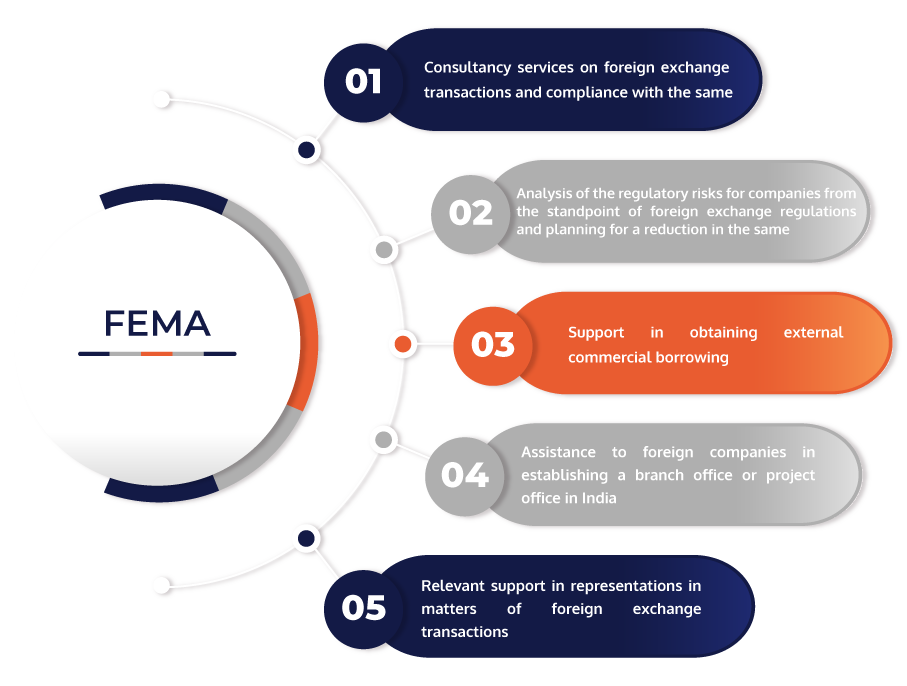

Foreign exchange regulations advisory

Our team of specialized international tax consultants provides relevant advisory services to companies regarding the handling of foreign exchange transactions for all inflow and outflow of currency. KMS helps its clients in settlement of funds in India or outside the country, especially in those foreign exchange transactions where permissions are required. Our international tax consulting services include advisory on foreign exchange transactions as per the provisions of the Foreign Exchange Management Act (FEMA):

BEPS impact analysis

Various tax jurisdictions are introducing measures to escalate their tax base and reduce certain deductions. Tax transparency and shifting of profits have come under scrutiny because they are perceived as abusive practices under the disguise of international tax planning. Therefore, OECD released its Base Erosion and Profit Shifting (BEPS) Action Plan in July 2013 to check any mismanagement in international taxation. Our team of BEPS experts works along with our clients to develop a tax plan that aligns with their goals and is legally compliant. We provide the necessary guidance in decision making and implementation of the tax plan in a specific country or globally as an essential part of our international tax advisory services.

Expatriate arrangement structuring

Multinational companies send their employees to other countries for handling the operations there in one of their group companies. Depending on the countries where the ex-pat is posted and the domestic company’s presence in the posted country, different ex-pat assignments require different structuring. The international tax experts at KMS help the clients in structuring such arrangements for setting up the entities and complying with the immigration, employment, and taxations regulations.

We help in forming the expatriate contracts to clarify the taxation of employees when working abroad or applicability of any additional taxes due to the assignment. Our experts select the best structuring for expatriates based on an understanding of the expatriate type, legal presence in the country of posting, payroll compliance and offshore wage payments, dual or co-employment, global employment company, visa or work permit, and ex-pat agreement.

Compliance & Litigation

Through our multiple international tax services, we handle all the litigation procedures for the tax authorities and tribunals for international tax matters and litigation diligently. We also advise clients on international tax compliance matters depending on the situations and the transactions.

INTERNATIONAL TAX COMPLIANCE

Tax transparency becomes difficult in the case of international tax matters. KMS’s team of reliable international tax compliance professionals ensures compliance with global tax systems, smooth exchange of financial information related to tax, prevent offshore tax evasion, and hence increase tax transparency. As a part of our international tax services, we understand the company structure to determine the applicable exemptions and obligations. We also complete any requirement of registration or notification to local authorities, review of documents, review of the relevant policies to ensure compliance in the respective jurisdiction, and preparation and filing of returns as required.

SUPPORT FOR LITIGATION AT TRIBUNALS, HIGH COURT, AND SUPER ME COURT

Our international tax advisory services include making representations before the tribunals or other authorities smoothly, avoiding any anomalies. We file appeals on behalf of clients, along with the proofs within the timelines. Our litigation support services include assistance to the clients in preparation and representation of international tax-related cases before the High Courts and Supreme Court of India. If the cases remain unsolved, we assist the clients in advance rulings. Our international tax litigation experts have the required business expertise of adopting a range of other preventive measures and alternate dispute resolution strategies if needed.

our client say

trust. transparency. professional expertise.