Tax Audit

Tax audit is an independent review of books of accounts of an entity by auditors required under the Income Tax Act, 1961.

Tax auditing and filing tax return on time with transparency and clear records is an important task for any assessee which is subjected to audit. To achieve this, one needs an independent tax auditor to carry out the task. KMS is your best option and trusted confidante when it comes to us, our team of experienced and dedicated auditors will provide value-added services to your accounts. We truly understand the sensitivity and importance of tax for the companies and other assessees, and we make sure we keep top-level of ethical standards and top-notch quality in our services.

Our team of auditors at KMS is in this profession for decades, and they have undertaken tax audits for several companies, whether small, medium, or large.

What is tax audit?

Section 44AB of the Income Tax Act 1961 requires that if the annual gross turnover or receipt of the company exceeds a specified limit, then it must get its accounts audited by a chartered accountant. The chartered accountant provides his findings and observations in his tax audit report in Form numbers 3CA/3CB and 3CD.

Difference between tax audit and statutory audit

A tax audit differs from a statutory audit on many grounds. A statutory audit is conducted to make sure proper reliability, transparency, fairness, and precision are maintained in the financial statements of the company. On the other hand, a tax audit is done for proper maintenance of books and to ensure that true data is reflected in the taxable income and deductions made by the firm.

As an eminent CA firm in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Check out our website to understand and know more about our services and firm.

Tax Audit Applicability

A taxpayer, whether in business or professional has to get a tax audit done if his turnover/receipts exceed tax audit limits as defined below:

Turn over limit for Business

If the annual gross turnover/receipts in business exceed Rs. 1 Crore, then tax audit is applicable.

For taxpayers who have opted for presumptive taxation under Section 44AD, the tax audit limit is Rs. 2 Crore

For taxpayers, whose aggregate of all the receipts & payments in cash during the previous year does not exceed 5% of total receipts & payments, the tax audit limit is Rs 5 crore from the financial year 2019-20.

Gross receipt limit for Professionals

If the annual gross receipts in profession exceed Rs. 50 Lakh then, the assessee has to get himself audited.

Further, the audit is also required in cases where the taxpayer is declaring lower net profit while declaring profit U/s 44AD, 44ADA, 44AE.

Tax Audit Due Date

The assessee is required to file an audit report by 30th September of the assessment year.

Tax Audit Penalty

As per Section 271B of the Income Tax Act 1961, the penalty for non-filing of the audit report is lower of:

- 0.5% of the total sales, turnover, or gross receipt

- Rs. 1,50,000

Tax audit objectives

tax auditing

We very firmly believe that our clients are our biggest assets, and when it comes to carrying out customer-centric services, we need to stand in their shoes and deliver exactly what they are looking for. We understand you are looking for an auditor who engages properly into intricacies to understand all the rules, regulations, and complex laws of the Indian tax system. We at KMS have a team of tax professionals who draw their expertise from diverse sources and decades of knowledge. We make sure we provide you a seamless tax auditing service and tax compliance service.

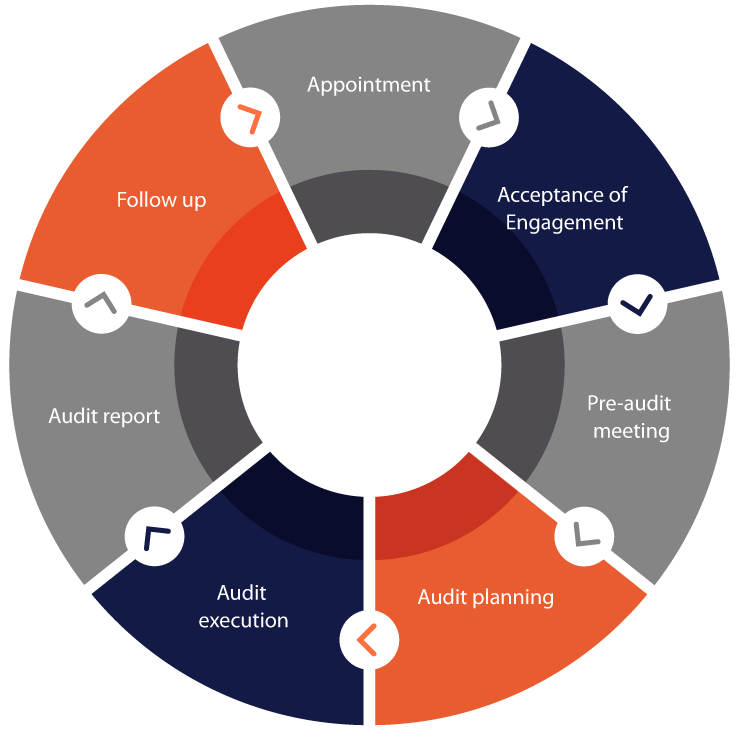

The Process

our client say

trust. transparency. professional expertise.