DTAA Advisory Services

Khandhar Mehta and Shah | DTAA Advisory Services

DTAA Advisory Services

KMS is one of the renowned DTAA advisory services providers in Ahmedabad.

We, at KMS, help you in getting out of this taxation complexities and uncertainties. Our DTAA consultants have a long-time experience in handling DTAA Advisory Services transactions and optimizing tax liability for income and profit earned overseas. We provide efficient DTAA Advisory Services through our capable and proficient team of DTAA advisors, who keep themselves updated on the tax and accounting issues across the globe and apply the same when handling clients’ global transactions.

What is DTAA

It is a globalized world.

Businesses are exploring opportunities to expand outside India to increase their reach and hence grow exponentially. It has increased the cross-border transactions of such globalized companies.

However, this growth also brings along with it, problems in taxation and accounting of transactions; specifically, the exposure to different tax regimes and the risk of the income being double taxed. This is where the Double Taxation Avoidance Agreements (DTAAs) serve as assistants to businesses. We provide DTAA Advisory Services to our esteemed clients and help them comply with legal provisions.

When there exist disagreeing rules between two countries regarding residential status and taxability of income, problems arise in the calculation of taxes and payments thereof. There is no common international ground for computation of income or taxes when two or more countries are involved. The tax laws of two countries may overlap, leading to double taxation on the same income or financial transaction or an asset. Thus arises the need for DTAA.

Such DTAAs between two countries provide relief on dual taxation. Hence, a country appears as an attractive destination for a non-resident individual and company to work and stay there. With DTAAs, countries aim to stimulate and develop economic trade and investment between the agreeing countries.

There are two types of DTAAs:

- Comprehensive DTAAs are the ones covering almost all types of incomes.

- While Limited DTAAs are the ones covering only certain types of incomes.

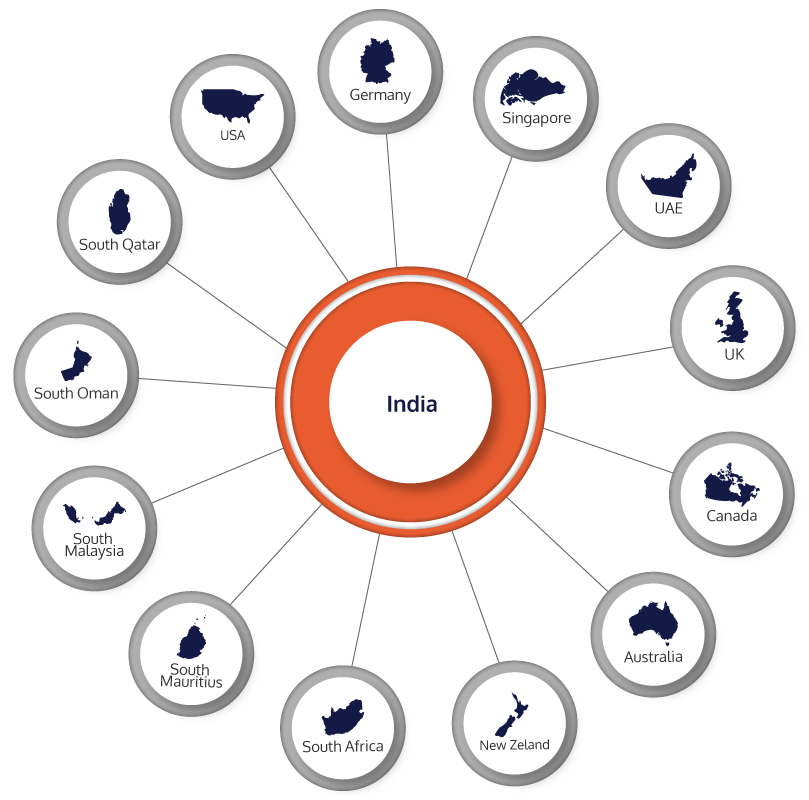

India has entered into DTAA with many countries:

The tax relief is in two forms: either a tax credit is given up to the amount the tax has been paid abroad or the income earned in a foreign country is exempt from tax in the country of residence. DTAAs may specify the relief from some specific tax or all taxes that can be covered, depending on the agreement between the two countries.

Being one of the top CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

DTAA Consulting Services

KMS provides its clients with expert DTAA advisory and consulting services. We ensure that the data on incomes are effectively managed, and calculations for tax are correctly done to avoid double taxation.

We also assist our clients by recommending them the various measures to maximize rebates, exemptions, and deductions under the applicable tax laws. Our DTAA advisors ensure that clients receive the top quality services for tax return preparation in both the countries involved in DTAA transactions.

We help our clients in the structuring of salary to minimize the Direct tax liabilities, determining the personal investment strategy for achieving the highest tax efficiency, and claiming for the foreign tax credit on dual-income returns. We assist our clients in getting the required documentation ready for these transactions.

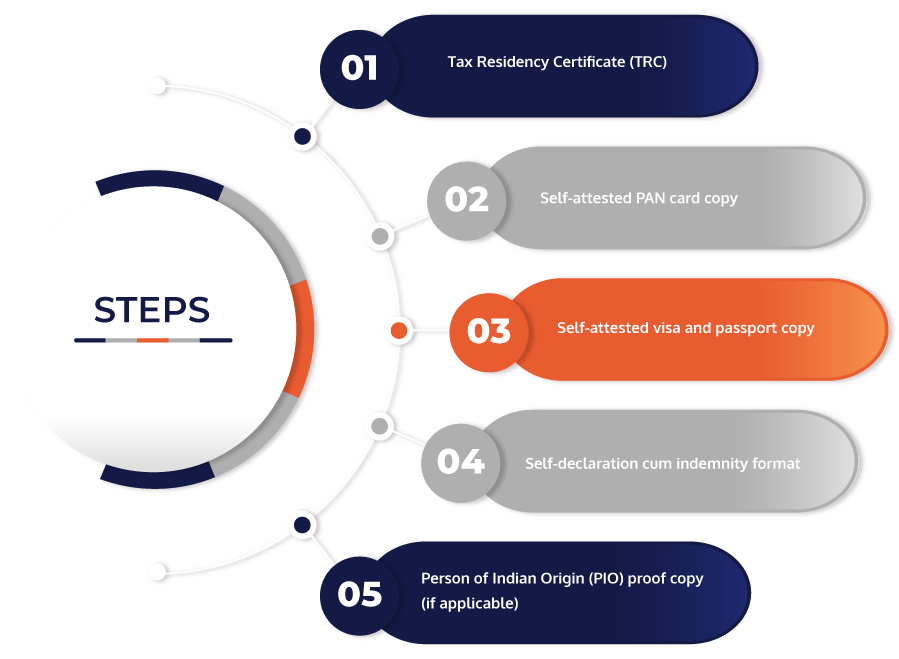

These documents include:

How to take DTAA benefits

As per the provisions of DTAA, NRIs need not pay tax twice on the following income earned from India:

our clients say

trust. transparency. professional expertise.