NRI Taxation Services

Khandhar Mehta and Shah | NRI Income Tax Services

NRI Income Tax Services

It gets difficult for the NRIs to manage their finances in India. They face challenges in keeping up-to-date on the amendments or new introductions of laws or regulations that may affect their tax liabilities and in remaining compliant with the ever-increasing compliance requirements. KMS is one of the leading NRI taxation services providers in Ahmedabad. KMS’s tax team of proficient and expert professionals guide the NRIs in all such processes and compliance issues. We have an incredible experience in handling matters related to income tax for NRIs, including their tax planning, tax return filing, compliance with various laws and transactions, purchase and sale of the property, and liaisoning services. We assist our clients by providing NRI Income Tax Services.

NRI Taxation Services

NRI Tax Return Filing

NRIs are required to file IT returns in India owing to any income earned in the country. Their income is exempt from most of the taxes. Our team’s comprehensive understanding of the NRI taxation services facilitates better services to them in terms of preparing and filing of non-resident Indian income tax returns.

Property Sale and TDS Compliance

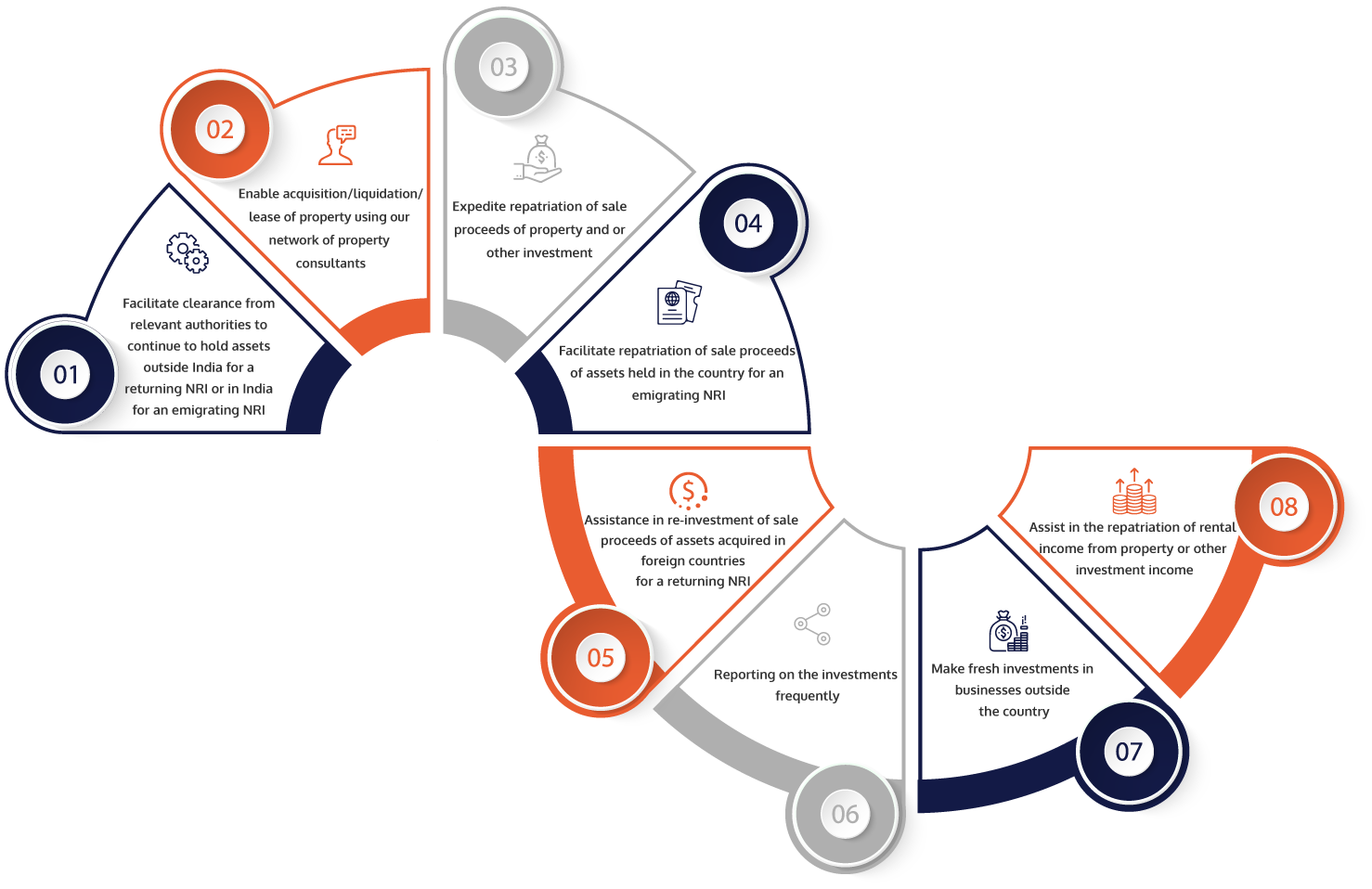

As a part of our NRI Income Tax Services, we help our NRI clients in handling their property and other investments in India to save their time investment in financial management in India:

NRI Tax Consultancy

We provide our expert NRI taxation consultancy services in handling their tax matters and compliance. KMS aims to maximize the wealth and value of its NRI customers, and hence we provide the required commercially focused tax advisory services. We understand the non-resident individual’s business or job, the investments, and customize our solutions based on their requirements. We adopt a results-oriented approach to optimize tax following the NRI taxation regulatory framework.

Being one of the famed CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

Liaisoning Services

Our NRI Taxation Services include liaisoning services for NRIs intending to set up a branch office or liaison office in the country under RBI permissions. Our team of NRI tax consultants has a good experience in handling such transactions – starting from understanding the right structure for the overseas company to the actual set-up of the company’s operations in India. We help them in devising the India Entry strategy and liaison with various authorities to ensure compliance with all the statutory registrations. We assist all our foreign clients in the evaluation of structuring options, selection of the best option based on their goals and economic situation, fulfilling related approvals, documentation, and attestation requirements, and annual compliance matters.

Tax Planning Services

NRIs who inherit assets in India, who intend to set up base in the country, returning NRIs, and the new NRIs find the taxation matters complicated and time-consuming as they do not understand the exemptions, deductions, and mandatory requirements. Our team of professional, well-read, and proficient NRI taxation consultants helps our NRI clients in proper tax planning to minimize their tax liability in the country. We also provide professionals help to the NRIs who either intend to liquidate the inherited assets in India or repatriate the sale proceeds of the same to them or manage it otherwise to achieve tax efficiency and reduction in the tax amount. Tax planning is also a critical aspect for NRIs who intend to return to India and first-time emigrants, and it is one of the core components of our NRI Taxation Services.

Other professional services

In addition to all the taxation-related services for NRIs, we provide other professional services that include:

What do our clients say about us?

trust. transparency. professional expertise.

frequently asked questions(faqs)

An individual is said to be resident in India if he/she satisfies the following conditions:

- If he/she is in India for a period of 182 days or more during the previous year; or

- If he/she is in India for a period of 60 days or more during the previous year and 365 days or more during four years immediately preceding the previous year.

In the second bullet point, 60 days is replaced by 182 days in case of an Indian citizen or a person of Indian Origin coming on a visit to India or 182 days in case of an Indian citizen going abroad for employment during the previous year. Here, a person is considered to be of Indian Origin if he/she or either of his/her parents or any of the grandparents, was born in undivided India. A company is a resident in India if it is an Indian company or during the previous year, the control and management are situated wholly in India.

Following incomes are exempt from tax in the hands of an NRI:

- Dividends from shares of domestic companies

- Interest on NRE & FCNR(Foreign Currency Non- Repatriable) account

- Long term capital gains from listed equity shares and equity-oriented mutual funds

- Interest on government-issued savings certificates and notified bonds

A resident of India may qualify as either resident and ordinarily resident (ROR) or resident but not ordinarily resident (RNOR). If, in addition to satisfying both the conditions for a resident, the individual satisfies the below two conditions, he/she is considered as ROR:

- Resident in India (as per the basic conditions mentioned above) in any two out of 10 previous financial years preceding the previous year and

- Physical presence in India is 730 days or more in the seven previous financial years preceding the previous year

If even one of the above conditions is not satisfied, then he/she is considered as RNOR.